Getting My $100 Loan Instant App To Work

Wiki Article

Some Ideas on Best Personal Loans You Need To Know

Table of ContentsInstant Cash Advance App - An OverviewThe Best Strategy To Use For Instant Cash Advance AppIndicators on $100 Loan Instant App You Need To KnowLoan Apps Fundamentals ExplainedWhat Does $100 Loan Instant App Do?The 3-Minute Rule for $100 Loan Instant App

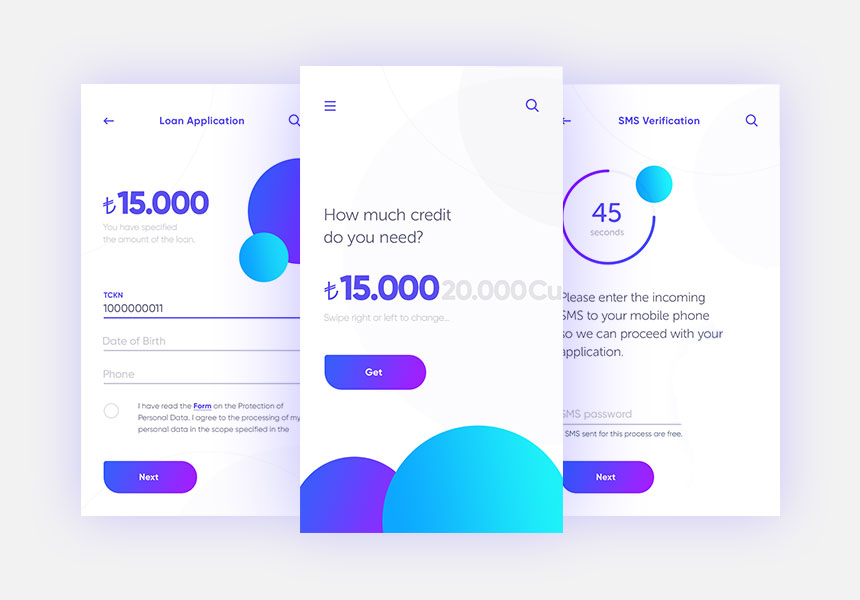

When we consider using for lendings, the imagery that enters your mind is individuals aligning in lines, waiting for plenty of follow-ups, and getting absolutely irritated. But innovation, as we understand it, has actually transformed the face of the borrowing organization. In today's economic situation, consumers and not lenders hold the trick.Financing authorization and documents to financing handling, every little thing is online. The several relied on online finance applications use debtors a platform to use for car loans quickly and offer authorization in minutes. You can take an from some of the very best cash car loan apps offered for download on Google Play Store and also Application Store.

You simply need to download the application or most likely to the Pay, Feeling site, authorize up, upload the needed files, as well as your car loan will get authorized. You will obtain notified when your finance demand is refined. Generally financing application used to take at the very least a couple of days. Sometimes, the lending approval used to get stretched to over a month.

How Best Personal Loans can Save You Time, Stress, and Money.

Usually, also after getting your finance approved, the procedure of getting the finance quantity transferred to you can require time as well as obtain made complex. That is not the instance with on the internet financing apps that supply a direct transfer alternative. Immediate finance apps supply instant individual finances in the range of Rs.

5,00,000 - $100 loan instant app. You can get an instant finance as per your qualification and also need from immediate financing apps. You do not have to stress the following time you desire to make use a small-ticket car loan as you recognize how valuable it is to take a lending utilizing online funding applications. Do away with the time-consuming and tedious process of availing of conventional personal finances.

Examine This Report on Instant Loan

You can be certain that you'll get a practical rates of interest, tenure, car loan amount, and various other benefits when you take a dig this funding with Pay, Sense Online Lending App.A digital borrowing system covers the entire lending lifecycle from application to dispensation into customers' savings account. By digitizing and also automating the financing process, the platform is transforming conventional banks into electronic lending institutions. In this write-up, let's explore the advantages that a digital borrowing platform can offer the table: what's in it for both banks as well as their customers, and also exactly how digital lending systems are disrupting the market.

Every bank now wants every little thing, including finances, to be refined quickly in real-time. Clients are no much longer eager to wait for days - not to mention to leave their homes - for a finance.

$100 Loan Instant App - An Overview

Today's Gen, Z and also millennials can not live without their smartphone. All of their everyday tasks, including monetary purchases for all their tasks and they choose doing their economic purchases on it too. They want the ease of making purchases or requesting a loan anytime from anywhere. It's very challenging to please.In this situation, electronic financing systems function as a one-stop service with little manual data input and rapid turn-around time from car loan application to cash in the account. Consumers need to have the ability to relocate flawlessly from one tool to one more to complete the application, be it the web and mobile interfaces.

Companies of digital financing platforms are required to make their products in conformity with these guidelines as well as assist the lending institutions concentrate on their organization only. Lenders likewise should see to it that the suppliers are updated with all the current standards released by the Regulators to quickly include them into the electronic loaning platform.

The Ultimate Guide To Best Personal Loans

The conventional manual borrowing system was a discomfort for both lender as well as debtor. Customers had to Source make numerous trips to the financial institutions as well as submit all kinds of files, as well as manually fill up out a number of kinds. loan apps.The Digital Financing platform has actually transformed the means banks consider and execute their lending purchase. Financial institutions can now deploy a fully-digital funding cycle leveraging the current innovations. A fantastic digital borrowing platform need to have very easy application submission, fast approvals, compliant financing processes, as well as the capacity to consistently improve process efficiency.

Customers will certainly need to look to non-bank sources of funding." It is crucial to keep in mind that lending is a very successful fintech sector, where 28% of the top 50 fintech business run. So if you're assuming of entering into lending, these are reassuring numbers undoubtedly. At its core, fintech is all regarding making typical economic procedures much faster and also more efficient.

The 2-Minute Rule for $100 Loan Instant App

One of the usual misconceptions is that fintech apps only profit monetary organizations. The application of fintech is currently spilling from financial institutions and lenders to small organizations. best personal loans., Chief executive officer of the repayment platform Veem, sums it site link finest: "Small businesses are looking to contract out complexity to someone else since they have enough to stress about.As you can see, the simplicity of usage covers the list, revealing how access and comfort provided by fintech platforms stand for a substantial vehicle driver for customer loyalty. You can use many fintech advancements to drive customer count on as well as retention for services.

Report this wiki page